Harvard endowment management plays a pivotal role in supporting Harvard University funding and its various initiatives. With a record-setting endowment of $53 billion, the complexities of managing such vast resources present both opportunities and challenges for the institution. While this substantial funding source allows for significant investments in financial aid dynamics and educational programs, a notable portion is restricted by donor conditions, limiting its flexibility. In today’s dynamic financial landscape, college endowment strategies must navigate investment returns risk and the pressures of university budgeting challenges, particularly in times of crisis. As Harvard contemplates its fiscal future, the importance of astute endowment management remains paramount to sustain its mission and operations.

The management of Harvard’s endowment is a crucial aspect of the university’s financial ecosystem, affecting numerous aspects such as research funding and student financial support. This extensive investment portfolio enables Harvard to flexibly address academic and operational needs, all while navigating the complexities inherent in long-term asset allocation. Given the intricacies of maintaining a robust college fund, strategies are often employed to mitigate potential investment risks and budgetary constraints. Moreover, the dynamics of financial aid depend heavily on the performance of the endowment, highlighting its significance in shaping student opportunities. Ultimately, the thoughtful administration of this resource is essential for ensuring Harvard’s continued prominence in higher education.

Understanding Harvard University Funding Mechanisms

Harvard University funding constitutes a blend of various sources, including tuition fees, alumni donations, research grants, and, notably, the university’s endowment. At present, the Harvard endowment stands at an impressive $53 billion, providing significant financial leverage. However, a substantial portion of this funding is allocated for specific purposes as dictated by donor restrictions. Many alumni contributions are designated for scholarships, research, and faculty support, which means that the university’s administrative discretion over these funds is limited.

The complexities of Harvard’s funding mechanisms emphasize the importance of understanding how a large endowment can create both opportunities and challenges. Financial aid dynamics are intricately linked to the endowment; while increased endowment revenues can enhance student financial assistance, they also pose strategic dilemmas regarding sustainability. It is crucial for the institution to balance immediate financial needs with broader long-term goals to ensure continued support for all areas of academia.

Evaluating College Endowment Strategies

College endowment strategies have significant implications for universities like Harvard, particularly in their approach to funding current operations while ensuring future growth. Many institutions adopt a more aggressive investment strategy, relying heavily on stocks and alternative investments to maximize returns. The focus is often on generating enough revenue to cover operating deficits and fund key initiatives without unduly depleting resources. What is vital here is that endowment managers must carefully assess the investment returns risk associated with their chosen strategies to avoid long-term pitfalls.

Moreover, endowment strategies impact not only the financial health of a university but also its ability to navigate budgeting challenges. When institutions, including Harvard, face economic downturns or disruptions, the reliance on their endowment becomes paramount. Adjustments to payout rates and the utilization of unrestricted funds can provide immediate relief; however, such tactics must be assessed for their sustainability over time. This ongoing balancing act shapes the very fabric of how colleges manage their financial futures.

Navigating Financial Aid Dynamics at Harvard

Financial aid dynamics at Harvard are deeply intertwined with the university’s endowment management practices. A substantial portion of the endowment is allocated to providing financial aid, allowing the institution to maintain a robust commitment to accessibility and equity in education. Harvard’s financial aid policies have become increasingly generous, especially during periods of economic uncertainty, reflecting the university’s strategic intention to attract and support a diverse student body regardless of financial background.

However, as Harvard continues to enhance its financial aid offerings, it also faces critical challenges in sustaining these commitments amid rising operational costs and potential funding cuts. The ongoing management of its endowment becomes a crucial determinant in this equation, as leaders must navigate the delicate balance of providing aid and maintaining institutional financial health. Without careful planning and evaluation of investment returns risk, universities could find themselves in precarious financial situations that ultimately affect their ability to serve prospective students.

Confronting University Budgeting Challenges

University budgeting challenges are prevalent, particularly within a large institution like Harvard, where rigid structures and donor restrictions complicate financial planning. The recent conflicts with governmental bodies regarding funding and research grants have exposed vulnerabilities in the university’s financial structure. As financial aid increases and operational expenses mount, the administration faces pressure to reassess their budget allocations and the role of the endowment in mitigating potential budgetary deficits.

To navigate these challenges effectively, the university requires a clear understanding of its funding sources, budgetary requirements, and strategic spending. This involves innovative budgeting solutions that consider both current financial pressures and long-term institutional goals. The complexities of Harvard’s endowment management and the broader influences of economic conditions must inform these budgeting strategies, ensuring that necessary adjustments do not jeopardize future academic initiatives or the university’s financial stability.

Implications of Investment Returns Risk

Investment returns risk is an ever-present concern for institutions managing sizable endowments, such as Harvard University. The strategic decisions made by endowment managers significantly influence not only immediate cash flow needs but also long-term viability. With fluctuating markets and economic uncertainties, the university must navigate this risk while striving to meet its operational demands, funding commitments, and growth objectives.

Moreover, when investment returns deviate from projections, financial resources can become strained, leading to challenging decisions regarding spending and endowment utilization. Harvard’s historical reliance on optimistic long-term returns necessitates periodic reevaluation of its investment strategies to ensure sustainable growth. This balancing act illustrates the need for foresight and adaptability in managing the endowment, as failing to account for risk could lead to substantial repercussions on Harvard’s financial future.

Exploring Harvard’s Endowment Management Strategies

Harvard’s endowment management strategies have garnered attention for their sophisticated approaches to investment and disbursement. The university employs a diversified investment strategy aimed at achieving an average annual return that supports both current operational needs and long-term growth. This includes tactical shifts in asset allocation responsive to market conditions and an emphasis on sustainability that aligns with Harvard’s mission to foster academic excellence.

However, as the complexities of global finance evolve, the university’s leadership must constantly adapt its strategies to optimize returns and mitigate risks associated with its endowment. This includes a keen awareness of external economic factors that can affect investment outcomes, such as market volatility and changes in regulatory environments. Emphasizing structured, long-term planning will be essential, as the endowment not only supports immediate academic initiatives but also safeguards the university’s future financial integrity.

Effects of Government Funding Cuts on Harvard

Government funding cuts can significantly impact institutions like Harvard University, especially when federal dollars are crucial for research and operational stability. The recent freeze of billions in grants exemplifies how shifting political dynamics can directly affect financial aid dynamics and general funding models. Such vulnerabilities necessitate that universities take proactive measures in managing their endowments to ensure that they can weather funding disruptions without jeopardizing their educational missions.

In times of financial uncertainty, effective endowment management becomes integral to sustaining research initiatives and academic programs. As Harvard examines its response to potential cuts in government funding, it may need to increase reliance on its endowment to fill the financial gaps that would otherwise disrupt ongoing projects. Adopting a strategic approach to endowment withdrawals, aimed at balancing immediate needs with long-term goals, will be critical in maintaining Harvard’s status as a leading educational institution.

Adapting to Financial Crises: Harvard’s Strategy

In times of financial crises, universities face the challenge of adapting to surging operational costs and declining revenues. Harvard has demonstrated resilience during past crises, but its strategy depends heavily on effective endowment management. The ability to swiftly allocate endowment funds to cover immediate needs, while concurrently planning for long-term recovery, is essential. This strategic adaptability can mean the difference between thriving or navigating a precarious financial landscape.

Consequently, Harvard’s approach must encompass a comprehensive understanding of its endowment’s restrictions and potential revenue sources. By employing scenario analyses, as mentioned in recent discussions, university leaders can evaluate how best to respond to financial shocks while safeguarding the institution’s future. This proactive stance allows Harvard to strategically navigate crises, ensuring that the university can endure economic turbulence without sacrificing its commitment to excellence.

Long-Term Planning: A Cornerstone for Harvard’s Future

Long-term planning is vital for Harvard University as it navigates the complexities of funding management amid changing economic landscapes. The university’s substantial endowment provides a unique advantage, enabling it to adopt a forward-looking approach in its strategic planning processes. By ensuring that spending decisions today do not compromise future resources, Harvard emphasizes the importance of sustainability in fostering academic growth and innovation.

Moreover, regular evaluations of funding strategies, influenced by changing market conditions and financial aid dynamics, help create a robust framework for making informed financial decisions. This long-term view empowers Harvard’s leadership to anticipate challenges and opportunities that lie ahead, ensuring the institution remains a leader in higher education for generations to come. By focusing on prudent endowment management, Harvard can sustain its mission while continuously adapting to the evolving landscape of higher education.

Frequently Asked Questions

What is involved in Harvard endowment management and its impact on university funding?

Harvard endowment management involves the strategic allocation and investment of the University’s $53 billion endowment to balance current financial needs with long-term sustainability. Effective management is crucial for ensuring a stable funding source that supports scholarships, faculty salaries, and essential operations. However, a significant portion of the endowment is restricted by donors, which complicates budgeting and calls for careful planning to address both immediate needs and future financial challenges.

How does Harvard’s endowment contribute to financial aid dynamics?

Harvard’s endowment plays a vital role in financial aid dynamics by funding a significant portion of the financial aid offered to students. Approximately one-fifth of the annual distribution from the endowment is allocated to financial aid, allowing the University to provide increasingly generous assistance and making education accessible to a broader range of students without overreliance on tuition revenues.

What are the key challenges in managing the Harvard endowment fund?

Key challenges in managing the Harvard endowment fund include navigating investment returns risks and maintaining a balance between current expenditures and future growth. The volatile nature of financial markets can lead to significant fluctuations in returns, which may affect the University’s budgeting strategies and long-term planning for initiatives supported by the endowment.

What strategies does Harvard use in college endowment management?

Harvard utilizes a combination of strategies in college endowment management, including targeted investment returns, careful spending plans, and scenario analyses to prepare for potential risks, such as reduced federal funding or external economic shocks. By managing payouts smartly and leveraging its substantial resources, Harvard aims to maintain financial stability and enhance educational offerings.

How does Harvard endowment management respond to university budgeting challenges?

Harvard endowment management responds to university budgeting challenges by employing a structured approach to spending. This includes adjusting payout rates, borrowing against endowment funds during emergencies, and conducting scenario analyses to prepare for potential funding decreases. Moreover, Harvard’s long-term focus allows it to implement necessary adjustments gradually, mitigating the impact on future budgets.

In what ways can the Harvard endowment be restricted by donors?

Donor restrictions on the Harvard endowment can significantly limit how funds are utilized. Most contributions are earmarked for specific purposes, such as professorships, scholarships, or research programs, leaving a minimal portion of the endowment unrestricted. This necessitates careful planning by the University to ensure compliance with donor intent while still meeting broader funding needs.

What are the implications of high volatility in Harvard’s endowment investments?

High volatility in Harvard’s endowment investments can lead to unpredictable cash flows, impacting the University’s financial stability. A downturn in the markets may result in reduced returns, affecting how much can be spent annually on financial aid and other operations. Harvard’s management strategy aims to mitigate these risks through cautious spending and conservative financial planning.

Why is it essential for Harvard to maintain a well-managed endowment?

Maintaining a well-managed endowment is essential for Harvard as it provides the financial flexibility needed to support long-term initiatives and respond to immediate fiscal demands. A robust endowment helps protect against economic uncertainties, ensuring that the University can uphold its commitments to education, research, and community service despite potential financial challenges.

| Key Point | Details |

|---|---|

| Total Endowment Value | Harvard’s endowment reached $53 billion, but most is restricted and only 5% is unrestricted. |

| Impact of Restrictions | Significant portions of the endowment are limited by donor restrictions and are allocated to specific schools. |

| External Risks | The endowment strategy faces potential challenges from political and financial uncertainties, such as grants being frozen by the government. |

| Short-Term vs Long-Term Planning | Harvard must balance immediate financial needs with sustainable long-term strategies to avoid future budget deficits. |

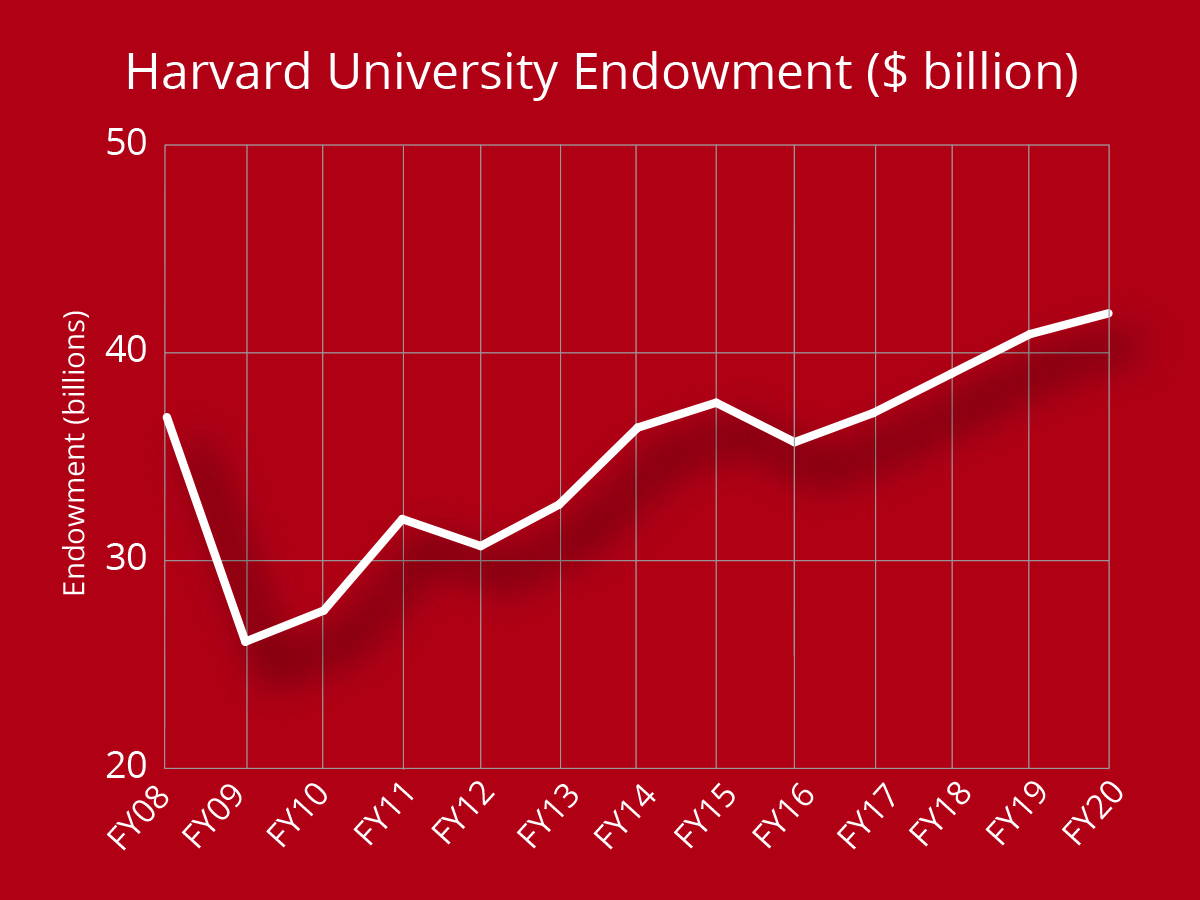

| Historical Volatility | Past financial crises have shown that endowment values can fluctuate wildly, impacting future budgets. |

| Scenarios for Future Planning | Proposed frameworks call for scenario analysis to anticipate potential risks and prepare for financial challenges. |

Summary

Harvard endowment management plays a critical role in balancing the university’s financial flexibility against potential risks. The endowment, while enormous, is heavily regulated by donor stipulations, limiting the funds available for immediate use. Navigating these complexities requires a careful strategy that addresses both present needs and future sustainability. In light of recent political pressures and economic uncertainty, it’s essential for Harvard to implement a robust planning framework that accounts for potential funding losses. By doing so, Harvard will strengthen its financial resilience while ensuring a commitment to long-term stability and growth.