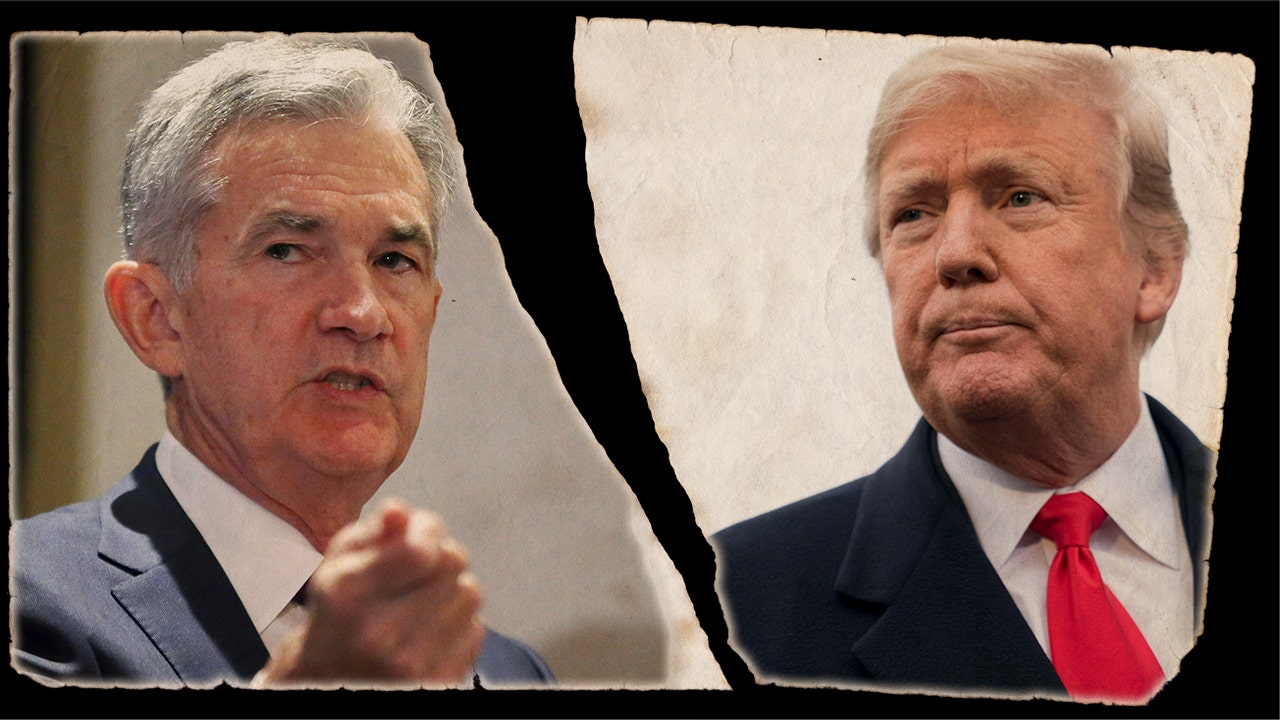

The question of whether Trump can fire the Fed chairman has become increasingly relevant as tensions rise between President Trump and Federal Reserve Chairman Jerome Powell. Once allies since Powell’s nomination in 2017, their relationship has soured, especially as Trump criticizes Powell for not adopting a more aggressive stance on interest rates. Many analysts believe that firing Powell could trigger significant market reactions, reflecting fears of undermined Federal Reserve independence and potential economic instability. Amid ongoing discussions about Trump’s Fed policy, the spotlight is on Powell’s role in shaping monetary policy during these turbulent times. As markets respond to this uncertainty, the implications of Trump’s potential actions on the Federal Reserve and interest rates remain a focal point for investors and policymakers alike.

Can the President remove the chair of the Federal Reserve? This contentious issue has reemerged as a hot topic in U.S. economic discourse, particularly against the backdrop of President Trump’s evolving interactions with Jerome Powell, the current head of the central bank. Amid discussions surrounding interest rate policies and potential market fallout, analysts are closely watching how this dynamic could influence the broader financial landscape. Trump’s previous commitment to appointing leaders that align with his economic vision raises questions about the future of monetary governance in America. As this narrative unfolds, the implications for the Federal Reserve’s autonomy and the overall economy demand careful consideration.

Can Trump Fire the Fed Chairman?

The question of whether President Trump can fire the Fed chairman, Jerome Powell, is steeped in legal complexities and interpretations of the Federal Reserve Act. The act grants the president certain powers related to the Federal Reserve but does not explicitly offer the same leeway concerning the chair’s position. Legal experts, including former Fed Board member Daniel Tarullo, argue that while the president might have some authority to remove governors from the Fed, the chair’s removal is not as straightforward. Such actions could lead to conflicts surrounding the independence of the Federal Reserve and raise concerns about executive overreach.

Trump’s relationship with Powell has been tumultuous, with pressure mounting due to economic policies and market reactions. The speculative threat to oust Powell not only unsettles financial markets but also raises profound questions about the implications for monetary policy. Market analysts have stressed the potential adverse effects on investor confidence should Trump decide to fire Powell, impacting interest rates and economic stability in the long term.

The Impact of Powell’s Possible Removal

Removing Jerome Powell before his term concludes could have significant ramifications for both the Federal Reserve’s independence and the broader economy. Financial markets may react sharply to such a move, anticipating a shift toward a more accommodating monetary policy to appease political agendas. This scenario could undermine the Fed’s credibility, potentially driving long-term interest rates higher as investors lose faith in the central banking system’s capability to manage inflation effectively.

Furthermore, many believe that a likely scramble for market stability would ensue if Powell were to be removed from his position. Analysts suggest that while Trump may wish for a more aggressive interest rate strategy, such attempts to influence the Fed could backfire. The central bank must maintain its independence to ensure that economic policies are guided by long-term growth and inflation control rather than short-term political strategies.

Jerome Powell and Trump’s Fed Policy Disputes

The disputes between Trump and Powell primarily revolve around monetary policy direction and handling of interest rates. Trump has publicly criticized the Fed chair for not adopting a looser monetary stance, claiming that more aggressive rate cuts are necessary to stimulate economic growth. Such disagreements have highlighted the friction within the administration regarding how best to approach economic recovery in an uncertain climate.

These policy discrepancies have direct implications for Jerome Powell’s efficacy as Fed chairman, as he is pressured to maintain a balanced approach to both inflation control and economic support. Many experts assert that while Trump may advocate for lower rates to foster immediate growth, the consequences of undermining the Fed chair could result in detrimental long-term economic fallout.

Legal Justifications for Ousting the Fed Chairman

A key legal question surrounding the potential removal of Jerome Powell lies in the interpretation of the Federal Reserve Act’s language regarding ‘for cause’ removal powers. While the act allows for governors to be dismissed under certain circumstances, ambiguities remain regarding whether the same conditions apply to the chair. Law scholars suggest that any attempt to remove Powell would face considerable judicial scrutiny, potentially leading to protracted legal battles that could disrupt market confidence.

Additionally, recent Supreme Court rulings pose further complications for the traditional understanding of ‘for cause’ removal protections within independent agencies. The evolving legal landscape suggests that if President Trump were to take action against Powell, the implications would extend beyond the individual and shake the very foundations of the Federal Reserve’s autonomy and stability.

Market Reactions to the Threat of Fed Leadership Changes

Market reactions in the wake of Trump’s threats to remove Fed chairman Jerome Powell can be described as relaying unease and volatility. Investors are acutely aware that changes in Fed leadership directly influence monetary policy, which in turn affects interest rates and investment decisions. The fear of a Democratic or Republican administration prioritizing short-term growth over long-term stability could result in increased volatility in financial markets, impacting everything from stock prices to Treasury yields.

Wall Street’s apprehension about potential leadership changes at the Federal Reserve stems from concerns over compromised independence resulting in improvised policy changes that moderate inflation targets. Historically, the market reaction to shifts in Fed governance has been swift; expectations of looser monetary policy often translate into rising yields on longer-term government bonds. This discord showcases the central banking system’s importance as a stabilizing force within the U.S. economy.

The Role of the Federal Reserve Chair in Economic Policy

The Federal Reserve chairman plays a pivotal role in shaping national monetary policy and provides essential leadership over monetary policy meetings that dictate interest rates. While some may perceive the chair as a singular force, in reality, their decisions are made through collaborative consensus-building at the Federal Open Market Committee (FOMC). Powell, like his predecessors, must navigate diverse opinions and economic data to forge policies that balance growth against inflation.

The chair’s influence on internal deliberations extends beyond mere votes; they must effectively communicate policy intentions to foster trust among investors and the public. As Powell seeks to maintain transparency while addressing Trump’s agenda, the role’s complexity is amplified by external political pressures. This dynamic encapsulates the delicate dance between the Fed’s operational independence and the administration’s expectations.

Implications of a New Fed Chair on Market Stability

Should President Trump choose to pursue the removal of Jerome Powell and appoint a new Fed chair, the potential ramifications for market stability would be profound. Markets often interpret such changes as signals of forthcoming shifts in monetary policy direction, typically towards a less austere stance. Investors glued to the Federal Reserve’s every move understand that appointing a new chair might provoke fear of inflation rebounding in response to higher spending—fears that could result in market sell-offs.

Moreover, if Powell were replaced by someone perceived to be more accommodative, the resulting question would be whether they would maintain the Fed’s credibility. A new appointee would not only have to navigate the immediate transition but also reassure markets regarding a consistent policy path that keeps inflation in check while fostering growth. Trust in the Federal Reserve’s objectives is critical to sustaining economic confidence, which underscores the significance of leadership continuity.

Future of Fed Independence Amid Political Pressure

The ongoing narrative surrounding Jerome Powell and President Trump’s criticisms foregrounds a crucial debate regarding the Federal Reserve’s independence in the face of political pressures. As the Fed operates autonomously under the premise of ensuring stable prices and maximum employment, any threats or attempts by the president to alter its leadership should be viewed with caution. This independence is imperative not only for effective monetary policy but also for maintaining public trust in the financial system.

Consequently, the future of the Fed’s independence hinges on existing judicial interpretations, prevailing economic conditions, and the political landscape. Should the Fed’s independence be compromised, fear of politicized monetary decisions could arise, threatening the credibility of the central bank and exacerbating uncertainty among investors. Thus, stakeholders must closely monitor how the Trump administration navigates its relationship with Powell and the overarching implications for economic policy.

Conclusion on Trump’s Influence over the Federal Reserve

In conclusion, the complexities surrounding Trump’s potential to fire the Federal Reserve chairman underscore the delicate balance between executive power and institutional integrity. As Jerome Powell continues to navigate the choppy waters of economic governance amidst political turbulence, the stakes for both the administration’s reputation and market stability are high. Trump’s public comments on interest rates, inflation, and Fed policy have only compounded the challenges faced within the central bank.

Ultimately, while the president wields significant influence in shaping economic discourse, any decisive action to fire Powell could potentially backfire, instigating market upheaval that undermines the very objectives that the Trump administration seeks to achieve. The Federal Reserve’s independence remains a cornerstone of effective monetary policy, and safeguarding it from political maneuvering is essential for sustaining long-term economic prosperity.

Frequently Asked Questions

Can Trump fire the Federal Reserve chairman Jerome Powell?

While President Trump has threatened to fire Jerome Powell, the Federal Reserve Act does not explicitly provide the president with the authority to remove the Fed chairman without cause. This has raised significant legal debates about presidential powers and the independence of the Federal Reserve.

What impact would firing the Federal Reserve chairman have on interest rates?

If Trump were to fire Jerome Powell, it could lead to immediate instability in financial markets, influencing interest rates. Markets generally fear that such an action could signal a shift towards a looser monetary policy, potentially driving longer-term rates higher due to concerns about inflation.

What has been the market reaction to Trump’s comments on Powell’s job security?

Market reaction to Trump’s threats regarding Powell has been negative, as investors worry that firing the Fed chair might undermine the central bank’s independence and credibility. This could result in increased volatility and uncertainty in financial markets.

What do analysts say about Trump’s remarks on Federal Reserve policy and Jerome Powell’s role?

Analysts caution that Trump’s critical remarks about Fed policy under Jerome Powell suggest a troubling trend for central bank independence. They believe such actions could negatively affect the Fed’s ability to manage inflation and monetary policy effectively.

How does Jerome Powell’s leadership affect Trump’s economic agenda?

Jerome Powell’s approach to interest rates and monetary policy often contrasts with Trump’s push for more aggressive economic stimulus measures. This misalignment has led to tensions, as Trump desires quicker actions to boost economic growth.

What legal arguments support or oppose firing the Federal Reserve chairman?

Legal arguments around firing the Fed chairman hinge on the interpretation of the Federal Reserve Act. Some contend that the president lacks the authority to dismiss the chair without cause, while others argue that the Supreme Court may have the final say on this executive power.

Has Trump expressed intentions to fire Powell, and what were the consequences?

Trump has previously hinted at wanting to remove Jerome Powell, which has created anxiety in financial markets. However, he later stated he had no immediate plans to do so, reflecting concerns about the repercussions such a dismissal could have on market stability.

What alternatives does Trump have instead of firing the Fed chairman?

Instead of firing Jerome Powell, Trump could wait until Powell’s term expires, allowing him to appoint a successor who aligns more closely with his economic policies, thereby potentially mitigating market concerns.

Why is the independence of the Federal Reserve crucial for the economy?

The independence of the Federal Reserve is essential because it enables the central bank to make decisions based on long-term economic indicators rather than short-term political pressures. This helps maintain stability and trust in monetary policy.

Could the Supreme Court influence Trump’s ability to fire Powell?

Yes, the Supreme Court may ultimately play a crucial role in interpreting presidential powers regarding the removal of the Federal Reserve chairman. Recent court decisions could reshape the traditional understanding of executive authority over independent agencies.

| Key Point | Details |

|---|---|

| Trump’s Relationship with Powell | President Trump has had a contentious relationship with Fed Chair Jerome Powell, often criticizing him for not being aggressive enough with interest rate cuts. |

| Possibility of Dismissal | While the Federal Reserve Act allows governors to be removed ‘for cause’, it’s unclear if this applies to the chair of the Fed. |

| Market Reactions | Any attempt to fire Powell could lead to significant market instability and uncertainty. |

| Concerns About Independence | Analysts warn that such a dismissal would undermine the Federal Reserve’s independence and credibility. |

| Potential Legal Challenges | Legal interpretations regarding the president’s ability to remove the Fed chair could be complex and uncertain. |

| Impact on Monetary Policy | Firing Powell could alter the Fed’s approach to monetary policy, potentially leading to higher inflation and economic instability. |

Summary

Can Trump fire the Fed chairman? This question has sparked significant debate in financial and political circles. While theoretically possible, any attempt to remove Jerome Powell from his position as Federal Reserve Chair could have severe repercussions for market stability and the credibility of the institution. Analysts suggest that such an action would not only risk undermining the Fed’s independence but could lead to heightened market volatility, as investors fear a shift toward more accommodating monetary policies. Ultimately, with Powell’s term ending next year, it may be more prudent for Trump to wait until he can appoint a new chair rather than incite turmoil by attempting to fire the current one.